By Bruce Raymond Wright

On April 6, 2016, the Department of Labor (DOL) released its long anticipated rules mandating that all advisors assume personal fiduciary responsibility in all of their dealings with all retirement plans. The new rule goes into full effect on April 10, 2017. The impact will be far reaching not only for advisors, but also for every manufacturer, distributor, and broker dealer involved with retirement plans. It even affects every property and casualty and/or life and disability agent who sells products to retirement plans and/or makes any offers or renders advice to retirement plans, the plan’s participants, sponsors or beneficiaries. Registered Investment Advisors (RIAs) and their firms have long been held to an even higher and broader standard of fiduciary behavior. The SEC is expected to release its new regulations related to fiduciary standards later in 2016.

Mandatory Changes

The Obama administration has intended these changes (and far more comprehensive) for years. Now that it is law, the natural progression would be to create fiduciary rules of conduct beyond retirement plans covering all aspects of financial advice, products, and services, mirroring the RIA standards. That has been the trend globally over the past decade. If the trend continues in America as it has in Europe, there will be no more commissions and far fewer (if any) packaged products such as variable life insurance or variable annuities.

Impact

Suitability standards under FINRA remain intact related to accounts that are not held in qualified retirement plans. However, the SEC regulations could extend fiduciary standards to all accounts, not just retirement accounts. Notwithstanding the industries preference for the ambiguities and minimal accountability found in FINRA suitability models, informed consumers will no longer tolerate them. The biggest impact will be in the minds and hearts of consumers, trustees, and just about every investor. Educated investors will not settle for “protection” under suitability standards on any account once they see how fiduciary standards provide far greater safety.

Plan providers, participants, and fiduciaries such as investment committee members are going to purge “advisors,” products, and models that are not contractually obligated to assure fiduciary responsibility. Intelligent investors (and their lawyers) will demand fiduciary treatment, transparency, and safety. They will stop subjecting themselves and their retirement plans to higher risk, conflicts of interest, hidden fees, high expenses, and withdrawal penalties.

The heyday of annuity products sold the old way is effectively over. Sales organizations will have to completely re-tool. A mandatory change of this magnitude will cause many sales leaders, managers, and agents to adapt or leave very quickly. The significant fines as well as criminal penalties will hammer those who are slow to adopt or who revert back to a sales mindset and behavioral patterns. These individuals and companies will be purged from the financial services professions.

What Does this Mean for Your Business?

Attracting or finding the right talent and expertise to get you from here to where you need to be next is easier today than ever before. Sound due diligence and vetting are essential to safeguarding you in your role as a corporate officer and fiduciary. We want to help you with that. The Wright Company is my intellectual property ownership and licensing business. It owns many intellectual properties including the world’s preeminent (and most profitable) fiduciary business model. That model has been used since 1990 to imagineer and orchestrate billions of dollars of re-positioned wealth while never being sued by even one client anywhere in the world. That’s the kind of proven track record that stands out when one is conducting a fiduciary due diligence search for excellence, understanding, training, and execution.

We invite you to experience a completely confidential courtesy call with me to discuss your personal and/or company’s needs. To arrange your free confidential call, please call my office at (800) 997-2664 if you are in the U.S.A. If you are calling internationally, please call +1-805-527-7516.

Bruce Raymond Wright is the inventor of Macro Strategic Planning® the world’s preeminent fiduciary business model. He is an internationally respected author, keynote speaker and change facilitator. Bruce’s latest book, Transcendent Thought and Market Leadership 1.0; How to Lead Any Profession, Anywhere in the World is available on Amazon.com and most online bookstores. Inquiries about keynote speeches, training programs, licensing, consulting, and mentoring can be emailed to [email protected] or you may call 805-527-7516 Monday through Friday between 10:00 – 4:00 PDT.

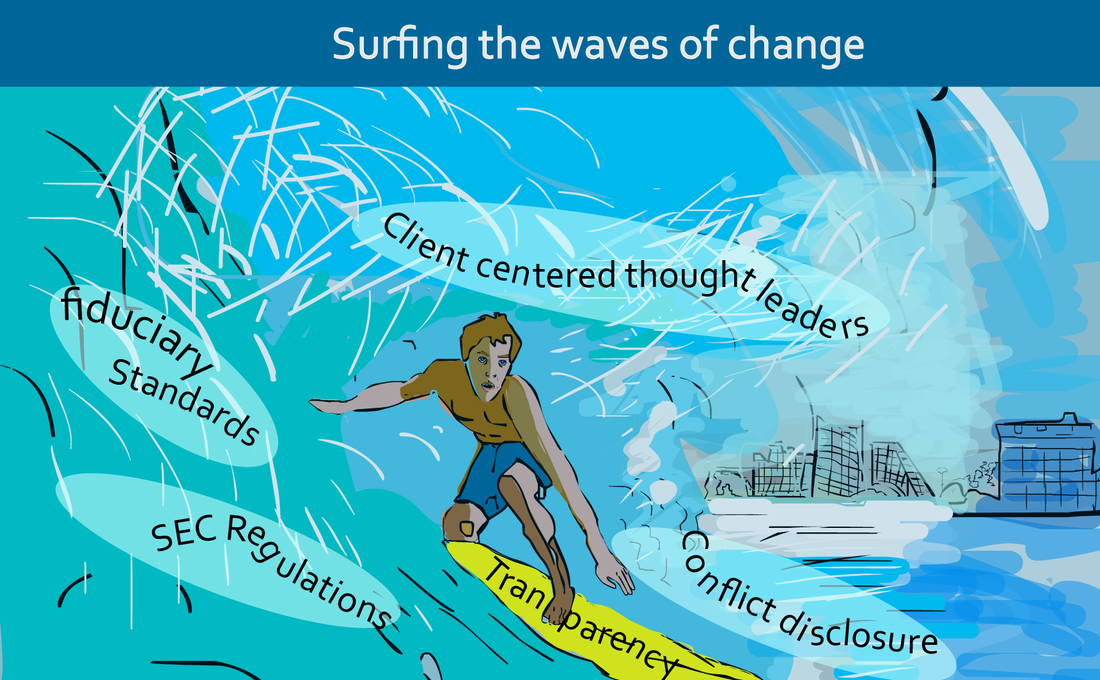

Artwork provided by Nicole Rose, a fine artist, author, compliance lawyer, and CEO of Create Training International based in Queensland, Australia.

On April 6, 2016, the Department of Labor (DOL) released its long anticipated rules mandating that all advisors assume personal fiduciary responsibility in all of their dealings with all retirement plans. The new rule goes into full effect on April 10, 2017. The impact will be far reaching not only for advisors, but also for every manufacturer, distributor, and broker dealer involved with retirement plans. It even affects every property and casualty and/or life and disability agent who sells products to retirement plans and/or makes any offers or renders advice to retirement plans, the plan’s participants, sponsors or beneficiaries. Registered Investment Advisors (RIAs) and their firms have long been held to an even higher and broader standard of fiduciary behavior. The SEC is expected to release its new regulations related to fiduciary standards later in 2016.

Mandatory Changes

The Obama administration has intended these changes (and far more comprehensive) for years. Now that it is law, the natural progression would be to create fiduciary rules of conduct beyond retirement plans covering all aspects of financial advice, products, and services, mirroring the RIA standards. That has been the trend globally over the past decade. If the trend continues in America as it has in Europe, there will be no more commissions and far fewer (if any) packaged products such as variable life insurance or variable annuities.

Impact

Suitability standards under FINRA remain intact related to accounts that are not held in qualified retirement plans. However, the SEC regulations could extend fiduciary standards to all accounts, not just retirement accounts. Notwithstanding the industries preference for the ambiguities and minimal accountability found in FINRA suitability models, informed consumers will no longer tolerate them. The biggest impact will be in the minds and hearts of consumers, trustees, and just about every investor. Educated investors will not settle for “protection” under suitability standards on any account once they see how fiduciary standards provide far greater safety.

Plan providers, participants, and fiduciaries such as investment committee members are going to purge “advisors,” products, and models that are not contractually obligated to assure fiduciary responsibility. Intelligent investors (and their lawyers) will demand fiduciary treatment, transparency, and safety. They will stop subjecting themselves and their retirement plans to higher risk, conflicts of interest, hidden fees, high expenses, and withdrawal penalties.

The heyday of annuity products sold the old way is effectively over. Sales organizations will have to completely re-tool. A mandatory change of this magnitude will cause many sales leaders, managers, and agents to adapt or leave very quickly. The significant fines as well as criminal penalties will hammer those who are slow to adopt or who revert back to a sales mindset and behavioral patterns. These individuals and companies will be purged from the financial services professions.

What Does this Mean for Your Business?

- Your Salesforce can learn how to think and act like a fiduciary must think and act. This includes a new and very elevated and detailed data intake process, note taking, comprehensive comparative analysis, transparency, and conflict disclosure. In fact, it’s a radically different way of being than what sales organizations or their people are familiar with. To protect the client’s best interests, you must actually know what they are and have them in a written plan. All that data and detailed notes spell disaster for salespeople who prefer ambiguity and less accountability.

- Your Board of Directors can choose not to adopt and stop all of your dealings with all retirement plans. This means the termination of those relationships and potentially all relations with those clients.

- Your BOD can wait for fiduciary standards to take over every aspect of financial advice and services, then re-tool and re-train.

- Your BOD can ignore the change, then consequently pay significant fines and/or see some of your salesforce and managers serve time in prison and be judicially removed from the profession.

- Your BOD could treat this as the greatest opportunity ever to position your firm and its representatives as client-centered thought leaders and ride this wave of change to market prominence.

Attracting or finding the right talent and expertise to get you from here to where you need to be next is easier today than ever before. Sound due diligence and vetting are essential to safeguarding you in your role as a corporate officer and fiduciary. We want to help you with that. The Wright Company is my intellectual property ownership and licensing business. It owns many intellectual properties including the world’s preeminent (and most profitable) fiduciary business model. That model has been used since 1990 to imagineer and orchestrate billions of dollars of re-positioned wealth while never being sued by even one client anywhere in the world. That’s the kind of proven track record that stands out when one is conducting a fiduciary due diligence search for excellence, understanding, training, and execution.

We invite you to experience a completely confidential courtesy call with me to discuss your personal and/or company’s needs. To arrange your free confidential call, please call my office at (800) 997-2664 if you are in the U.S.A. If you are calling internationally, please call +1-805-527-7516.

Bruce Raymond Wright is the inventor of Macro Strategic Planning® the world’s preeminent fiduciary business model. He is an internationally respected author, keynote speaker and change facilitator. Bruce’s latest book, Transcendent Thought and Market Leadership 1.0; How to Lead Any Profession, Anywhere in the World is available on Amazon.com and most online bookstores. Inquiries about keynote speeches, training programs, licensing, consulting, and mentoring can be emailed to [email protected] or you may call 805-527-7516 Monday through Friday between 10:00 – 4:00 PDT.

Artwork provided by Nicole Rose, a fine artist, author, compliance lawyer, and CEO of Create Training International based in Queensland, Australia.

RSS Feed

RSS Feed